Tax records are a valuable yet often overlooked resource for genealogists. These documents provide rich insights into the lives of our ancestors, revealing details about their property, financial status, and even their movements across regions. From property taxes to poll taxes and income taxes, these records can fill in gaps that other sources leave behind.

Understanding Tax Records

Understanding tax records is crucial for anyone tracing their family history. These records provide a wealth of information that can help establish ancestral connections and offer insights into the lives of our forebears.

Definition and Types of Tax Records

Tax records come in various forms, each offering unique details about our ancestors. Knowing the different types can help target your research more effectively.

Property Tax Records

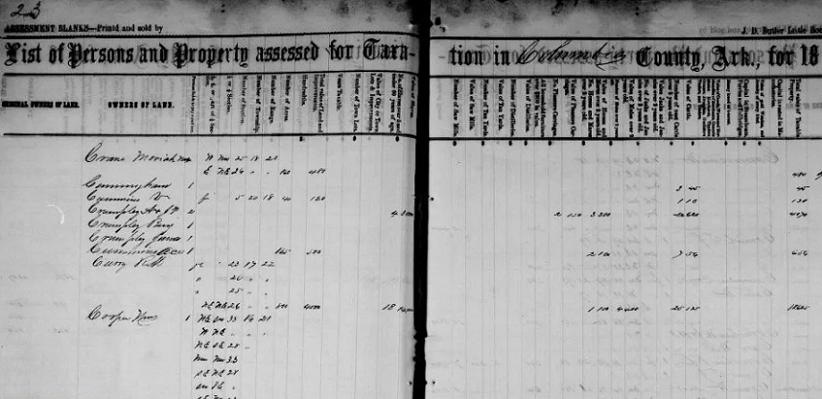

Property tax records list the owners of real estate and sometimes provide descriptions of the property. These records can indicate how long a family owned a piece of land and can reveal changes in ownership that might suggest inheritance or sales.

Poll Tax Records

Poll taxes were levied on individuals, typically adult males, as a fixed sum. These records can verify the presence of a person in a specific location during a particular time and sometimes provide additional information like occupation or age.

Income Tax Records

Income tax records provide information about a person’s earnings and financial status. These records are particularly useful in understanding the economic conditions of your ancestors and can sometimes reveal employment details.

Historical Context of Tax Records

Tax records have a long history, dating back to ancient civilizations. Understanding the historical context in which these records were created helps interpret them accurately. For example, knowing when certain taxes were introduced or abolished can explain why records appear or disappear in particular periods.

Geographic Variations in Tax Records

Tax records can vary significantly from one region to another. Different countries, states, and even municipalities had unique tax systems. Familiarizing yourself with the specific practices of the area where your ancestors lived will help in locating and understanding these records [1].

Accessing Tax Records

Accessing tax records can be an invaluable step in tracing your ancestry. These records can be found in various places, both online and offline. Knowing where and how to search can make the process more efficient and productive.

Online Resources

The internet offers a treasure trove of resources for genealogists seeking tax records. Many websites and databases provide easy access to digitized records.

Genealogy Websites

Websites like Ancestry.com, FamilySearch.org, and MyHeritage.com have extensive collections of tax records. These platforms often allow users to search by name, location, and date, making it easier to find relevant information.

Government Databases

Many governments have digitized their archives and made them available online. National, state, and local government websites may host databases where you can search for tax records. Examples include the National Archives and state or provincial archives.

Digital Archives

Other digital archives, such as those maintained by historical societies or universities, can also be valuable resources. These archives often include tax records that may not be available on commercial genealogy websites.

Physical Archives

While online resources are convenient, physical archives still hold a wealth of information. Visiting these archives can provide access to records that have not yet been digitized.

Local Government Offices

Local government offices, such as county courthouses or city halls, often maintain tax records. These records can include property tax rolls, poll tax registers, and other documents that are invaluable for genealogical research.

Libraries and Historical Societies

Many libraries and historical societies have special collections of tax records. These institutions can be excellent places to find old tax rolls, historical tax maps, and other related documents.

Specialized Genealogy Libraries

Some libraries specialize in genealogical research and house extensive collections of tax records. Examples include the Family History Library in Salt Lake City and the New England Historic Genealogical Society Library [2].

Hiring Professional Researchers

If accessing tax records on your own proves challenging, professional researchers can assist. These experts are skilled in navigating archives and databases, and they often have access to resources not readily available to the public.

Interpreting Tax Records

Interpreting tax records is a crucial step in using them for genealogical research. These records contain a wealth of information, but understanding their content and context is essential to uncover the full story of your ancestors.

Identifying Key Information

Tax records can provide various types of information that are key to genealogical research. Knowing what to look for can make the process more effective.

Names and Relationships

Tax records often list the names of individuals, which can help confirm family connections. Sometimes, they include information about relationships, such as spouses or children, which can be crucial in constructing family trees.

Property Descriptions

Descriptions of property can offer insights into the lives of your ancestors. Details about land size, location, and value can indicate economic status and provide clues about the living conditions and lifestyle of the family.

Financial Information

Financial information in tax records, such as amounts paid, can help assess the wealth and economic position of your ancestors. This information can be compared across years to track changes in financial status [3].

Recognizing Common Abbreviations and Terms

Tax records often use abbreviations and terms specific to the period and locality. Recognizing these can help in accurately interpreting the data.

Cross-Referencing with Other Genealogical Records

To verify and enrich the information found in tax records, cross-referencing with other genealogical records is essential. This can provide a more comprehensive picture of your ancestors’ lives.

Using Tax Records to Build a Family Tree

Tax records are invaluable tools for genealogists. They provide detailed information that can help construct a more accurate and complete family tree. Understanding how to use these records effectively is key to uncovering your family history.

Establishing Residence and Migration Patterns

Tax records can show where your ancestors lived and how long they stayed in one place. By tracking these records over time, you can identify migration patterns and discover when and why your ancestors moved [4].

Confirming Family Relationships

Tax records often list the names of individuals and their relationships to one another. This information can confirm family connections and help fill in gaps in your family tree. For example, if a tax record lists a property owner and their spouse, it provides confirmation of that relationship.

Uncovering Economic and Social Status

The details in tax records about property values and taxes paid can reveal the economic status of your ancestors. This information can give you insights into their social standing and lifestyle. By comparing these records over time, you can see how your family’s economic situation changed and what might have influenced these changes.

References

[1] Tax Records Could Offer Surprisingly Rich Details About Your Ancestors

[2] Resources for Genealogists: Tax Records

[3] The Value of Using US Tax Records in Genealogy Research

[4] The Taxman Cometh: Researching in Tax Records